FINANCIAL TOOL

Investment Grade Bonds

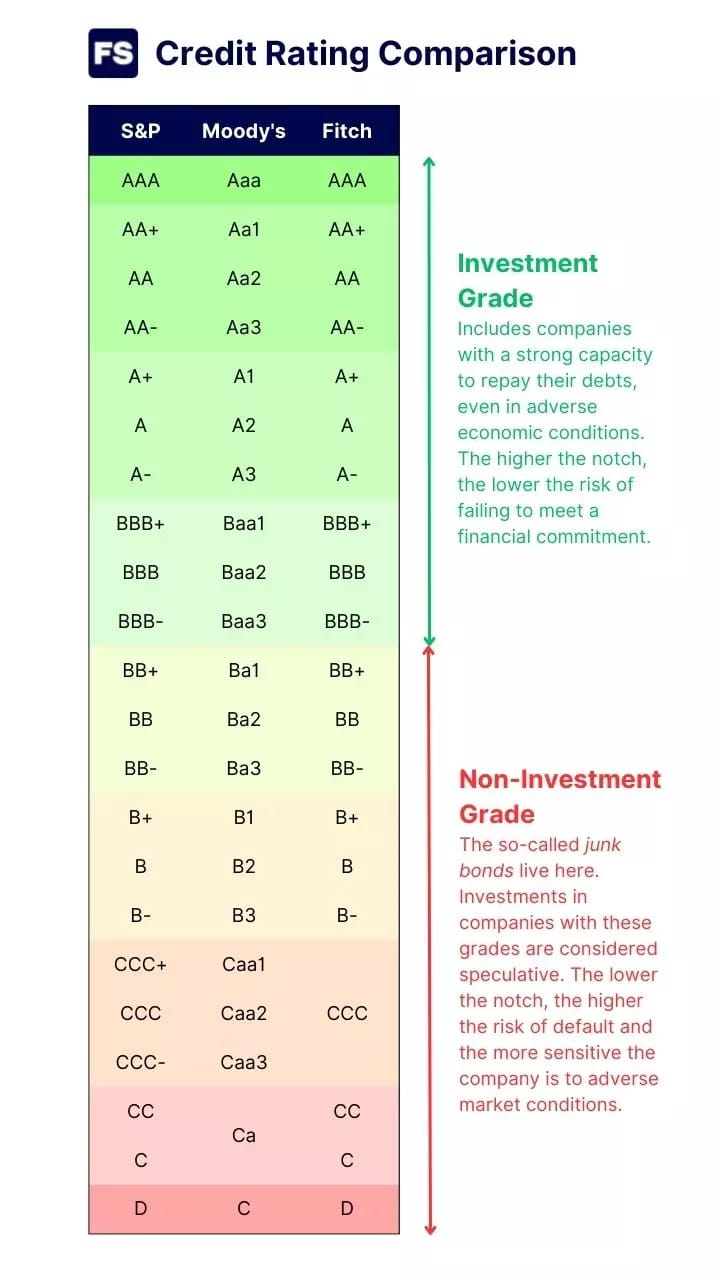

There are three main bond rating agencies in the US: Standard & Poor’s, Moody’s, and Fitch Ratings.

They evaluate the capability of a government or corporation to make its interest and principal payments as per the original bond contract.

While there are several tiers that a bond can be rated, it’s simplest to think in terms of investment grade versus junk bonds.

It’s important to understand the difference between these two types!

The first reason bonds are included in any portfolio is to capture a better than cash return while keeping volatility lower than stock.

The second reason is that bond values move largely independently of stock values, and this low correlation enhances diversification and reduces overall risk based on any one economic driver.

But here’s the thing: these two reasons apply mainly to investment grade bonds. That is, they apply to bonds which are highly unlikely to default.

US Treasuries are generally considered the safest bonds that can be purchased, because of the power to tax and borrow almost without limit. Corporate bonds of strong companies are next in line, but because of the additional risk (no power to tax, limited power to borrow), investors demand a slightly higher interest rates above the US Treasury rates.

Investment grade bonds are especially important for short- and intermediate-term investors. Anyone looking to invest for 10 years or less before needing access to a significant portion of their funds would likely benefit from holding 30%-100% in investment grade bonds. The exact amount depends on their goals, flexibility and personal risk aversion.

While I’ll cover junk bonds separately, suffice it to say here that their enticingly high interest rates are not as attractive as they first might appear. For anyone needing largely predictable returns (say if they’re saving for a house or other large purchase), junk bonds are not ideal.

For most investors, bond ETFs are a great option for achieving diversity and liquidity. Some junk bonds are usually included in any bond ETF, but those who wish to limit their risk should aim for exposure of 10% or less.

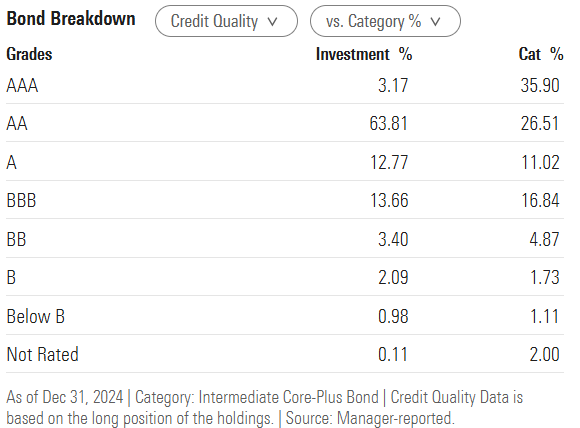

Morningstar.com offers an excellent breakdown of bond quality within an ETF under their Portfolio tab.

For example, Morningstar shows the following breakdown for iShares Core Total USD Bond Market ETF (IUSB):

*Investment % describes the make-up of the ETF. This is compared with the average constitution of others in its category.

And finally, as a guide to the ratings, this graph from Financestu.com shows the three rating systems and what constitutes investment grade: